The deduction limits apply to an S corporation and to each shareholder. The S corporation allocates its deduction to the shareholders who then take their section 179 deduction subject to the limits. The basis of a partnership’s section 179 property must be reduced by the section 179 deduction elected by the partnership. This reduction of basis must be made even if a partner cannot deduct all or part of the section 179 deduction allocated to that partner by the partnership because of the limits.

- The unadjusted depreciable basis and depreciation reserve of the GAA are not affected by the sale of the machine.

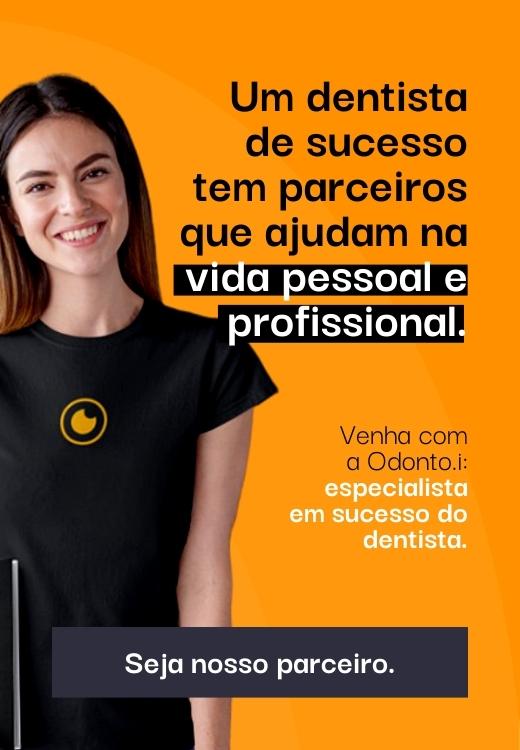

- Here is a graph showing the book value of an asset over time with each different method.

- Under this method, the depreciation calculation is done by deducting the residual value from the Cost of the asset and then the amount is divided by the number of years the asset was used for or its useful life.

- The Schedule of Depreciation is a table that charts the depreciation of an asset over the years that it serves your business.

Ready and available for a specific use whether in a trade or business, the production of income, a tax-exempt activity, or a personal activity. You must provide the information about your listed property requested in Section A of Part V of Form 4562, if you claim either of the following deductions. You can account for uses that can be considered part of a single use, such as a round trip or uninterrupted business use, by a single record. For example, you can account for the use of a truck to make deliveries at several locations that begin and end at the business premises and can include a stop at the business in between deliveries by a single record of miles driven. You can account for the use of a passenger automobile by a salesperson for a business trip away from home over a period of time by a single record of miles traveled.

Best Free Accounting Software for Small Businesses

This method can lead to different results than the double-declining method. The beginning book value refers to the asset’s value at the start of the year. Depreciation stops when book value is equal to the scrap value of the asset. In the end, the sum of accumulated depreciation and scrap value equals the original cost. Suppose an asset has original cost $70,000, salvage value $10,000, and is expected to produce 6,000 units. Depreciation is how an asset’s book value is “used up” as it helps to generate revenue.

- You placed both machines in service in the same year you bought them.

- If you are an employee, do not treat your use of listed property as business use unless it is for your employer’s convenience and is required as a condition of your employment.

- Each partner adds the amount allocated from partnerships (shown on Schedule K-1 (Form 1065), Partner’s Share of Income, Deductions, Credits, etc.) to their nonpartnership section 179 costs and then applies the dollar limit to this total.

- You determine the midpoint of the tax year by dividing the number of days in the tax year by 2.

If you dispose of property before the end of its recovery period, see Using the Applicable Convention, later, for information on how to figure depreciation for the year you dispose of it. Under this convention, you treat all property placed in service or disposed of during any quarter of the tax year as placed in service or disposed of at the midpoint of that quarter. This means that, for a 12-month tax year, 1½ months of depreciation is allowed for the quarter the property is placed in service or disposed of. The recovery periods for most property are generally longer under ADS than they are under GDS.

Composite depreciation method

If you and your spouse file separate returns, you are treated as one taxpayer for the dollar limit, including the reduction for costs over $2,700,000. You must allocate the dollar limit (after any reduction) between you equally, unless you both elect a different allocation. If the percentages elected by each of you do not total 100%, 50% will be allocated to each of you. You can include participations and residuals in the adjusted basis of the property for purposes of computing your depreciation deduction under the income forecast method.

During these weeks, your business use of the automobile does not follow a consistent pattern. During the fourth week of each month, you delivered all business orders taken during the previous month. The business use of your automobile, as supported by adequate records, is 70% of its total use during that fourth week. You can use the following worksheet to figure your depreciation deduction using the percentage tables. John Maple is the sole proprietor of a plumbing contracting business. As part of Richard’s pay, Richard is allowed to use one of the company automobiles for personal use.

Different methods of asset depreciation are used to more accurately reflect the depreciation and current value of an asset. A company may elect to use one depreciation method over another in order to gain tax or cash flow advantages. You need economic order quantity to determine a suitable way to allocate cost of the asset over the periods during which the asset is used. Generally, the method of depreciation to be used depends upon the patterns of expected benefits obtainable from a given asset.

Everything You Need to Know About Professional Tax in Andhra Pradesh

Under this convention, you treat all property placed in service or disposed of during a tax year as placed in service or disposed of at the midpoint of the year. This means that for a 12-month tax year, a one-half year of depreciation is allowed for the year the property is placed in service or disposed of. The ADS recovery period for any property leased under a lease agreement to a tax-exempt organization, governmental unit, or foreign person or entity (other than a partnership) cannot be less than 125% of the lease term. However, if this dual-use property does represent a significant portion of your leasing property, you must prove that this property is qualified rent-to-own property. For information about how to determine the cost or other basis of property, see What Is the Basis of Your Depreciable Property? Generally, the rules that apply to a partnership and its partners also apply to an S corporation and its shareholders.

Depreciation for the third year under the 200% DB method is $192. You use the calendar year and place nonresidential real property in service in August. The property is in service 4 full months (September, October, November, and December). You multiply the depreciation for a full year by 4.5/12, or 0.375. For property for which you used a half-year convention, the depreciation deduction for the year of the disposition is half the depreciation determined for the full year.

Assets and Their Depreciation

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. Assets that don’t lose their value, such as land, do not get depreciated. Alternatively, you wouldn’t depreciate inexpensive items that are only useful in the short term. We believe everyone should be able to make financial decisions with confidence.

After you have set up a GAA, you generally figure the MACRS depreciation for it by using the applicable depreciation method, recovery period, and convention for the property in the GAA. For each GAA, record the depreciation allowance in a separate depreciation reserve account. Under MACRS, Tara is allowed 4 months of depreciation for the short tax year that consists of 10 months. The corporation first multiplies the basis ($1,000) by 40% to get the depreciation for a full tax year of $400. The corporation then multiplies $400 by 4/12 to get the short tax year depreciation of $133.

You used the mid-quarter convention because this was the only item of business property you placed in service in 2019 and it was placed in service during the last 3 months of your tax year. Your property is in the 5-year property class, so you used Table A-5 to figure your depreciation deduction. Your deductions for 2019, 2020, and 2021 were $500 (5% of $10,000), $3,800 (38% of $10,000), and $2,280 (22.80% of $10,000), respectively. To determine your depreciation deduction for 2022, first figure the deduction for the full year. April is in the second quarter of the year, so you multiply $1,368 by 37.5% (0.375) to get your depreciation deduction of $513 for 2022.

They do not qualify as section 179 property because you and your father are related persons. You cannot claim a section 179 deduction for the cost of these machines. To qualify for the section 179 deduction, your property must have been acquired by purchase.

To determine basis, you need to know the cost or other basis of your property. You stop depreciating property when you have fully recovered your cost or other basis. You fully recover your basis when your section 179 deduction, allowed or allowable depreciation deductions, and salvage value, if applicable, equal the cost or investment in the property. If you place property in service in a personal activity, you cannot claim depreciation. However, if you change the property’s use to use in a business or income-producing activity, then you can begin to depreciate it at the time of the change.